39+ Real Estate Depreciation Calculator

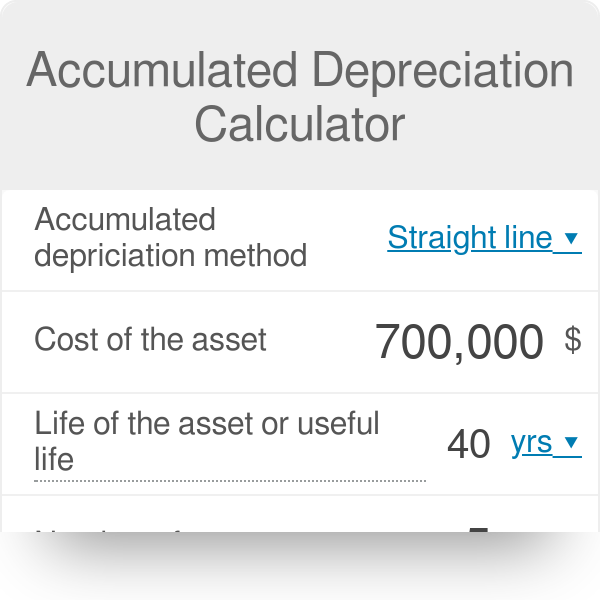

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real. Current book value x depreciation rate.

Depreciation Calculator Telematicsplus

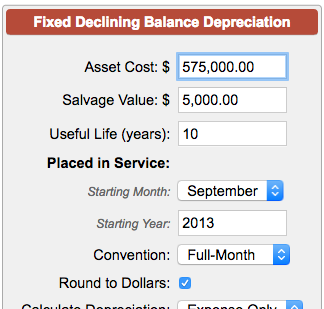

Web Percentage Declining Balance Depreciation Calculator.

. Web Calculate depreciation and create depreciation schedules. Web Utilize our depreciation calculator to determine your allowable annual depreciation for your real estate investment property and find your accumulated depreciation total. Web special depreciation allowance is 80 for certain qualified property acquired after September 27 2017 and placed in service after December 31 2022 and before January.

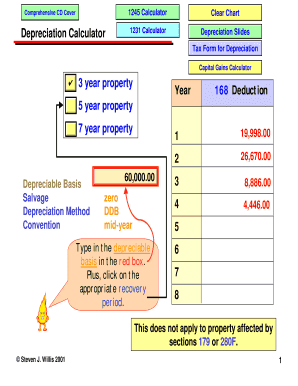

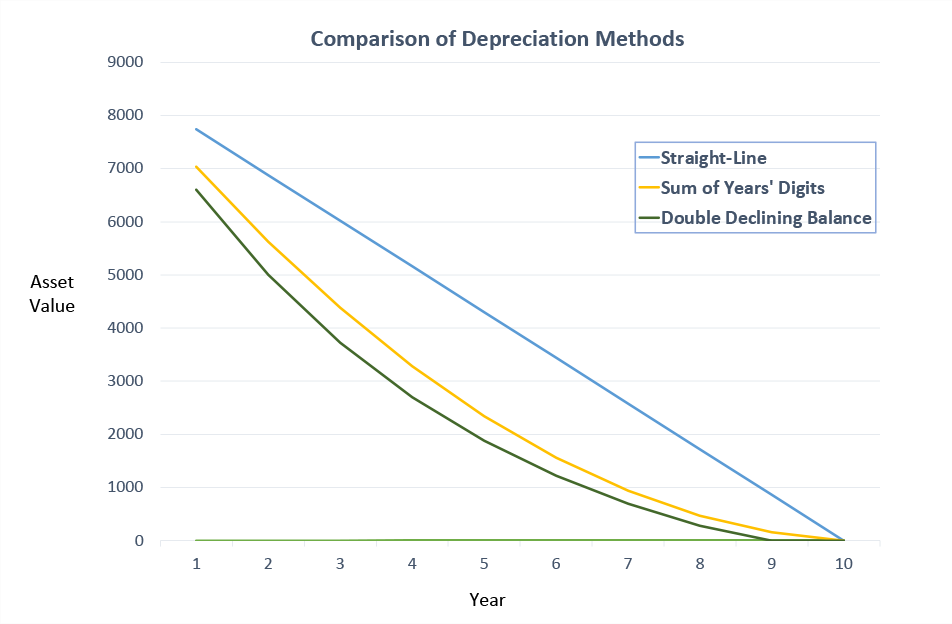

Calculate Understand Your Potential Returns. Web Section 179 deduction dollar limits. Includes online calculators for activity declining balance double declining balance straight line sum of.

Web This is a simple linear form of depreciation. Use Our Fast 100 Free Calculator to Get Your Houses Estimated Value. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Ad Calculate Your Houses Estimated Market Value in Less Than 2 Minutes. Web Depreciation is the loss or decline in an assets value over time. Web By convention most US.

This limit is reduced by the amount by which the. Ad Property Can Be An Excellent Investment. See Publication 946 How to Depreciate Property.

It uses the following. Web Real Property is 39 year property office furniture is 7 year property and autos and trucks are 5 year property. Web Our declining balance depreciation calculator can also find out the end book value of your asset after a specific number of years have passed.

Web Calculating Depreciation Using the Declining Balance Method. Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. Web Depending on the property type depreciation deductions are spread over 275 years for residential properties and up to 39 years for commercial properties but it.

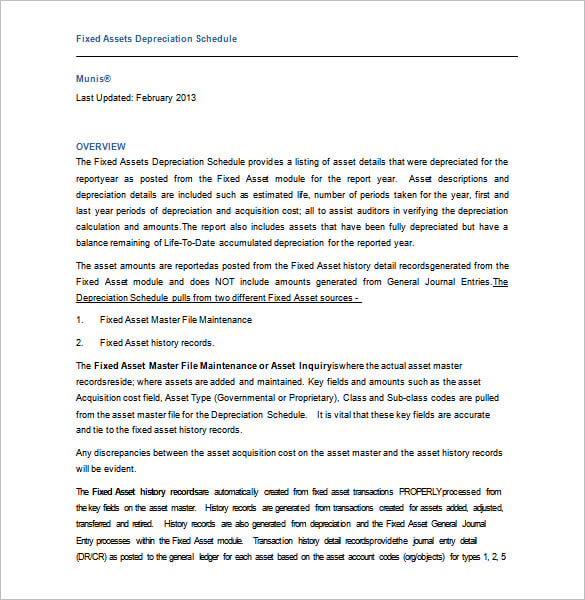

When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. Plan Your Property Investment Returns With AARPs Investment Property Calculator. Web The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated.

For instance a widget-making machine is said to. Residential rental property is typically depreciated at a rate of 3636 each year for 275 years. There are various ways to calculate depreciation but the simplest is by using the straight-line basis.

First estimate the assets salvage value which is the residual value of an asset at the end of its useful life. Web Calculate Property Depreciation with this Calculator. For example if you.

Only the value of buildings can be. 25000 x 30 7500.

Fixed Declining Balance Depreciation Calculator

How To Use A Home Depreciation Calculator Fortunebuilders

Depreciation Calculator

Aznx4y9tqvrwem

16 Printable Depreciation Calculator Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Appreciation Depreciation Calculator Salecalc Com

Guide On Condo Depreciation Calculator Mashvisor

How Is Rental Property Depreciation Calculated Free Calculator

How To Debug The Depreciation Calculation In New Depreciation Engine Sap Blogs

7 Depreciation Schedule Templates Doc Pdf

Accumulated Depreciation Calculator

How To Use A Home Depreciation Calculator Fortunebuilders

Depreciation Calculator

How Is Rental Property Depreciation Calculated Free Calculator

Asset Depreciation Calculator

How Is Rental Property Depreciation Calculated Free Calculator

Depreciation Calculator